The Telfer School of Management, known for its strong academics and unparalleled student experience, attracts thousands of undergraduate and graduate students every year. Starting with humble roots in 1969, the School found tremendous success in the last five decades. Remarkably, the story of our namesake, the man with whom we share the name, is much the same.

It’s a story of an undeniable drive to succeed, dating back to 1976. It’s a story of the one and only, Ian Telfer. And it’s a good one.

From Humble Beginnings to Hall-of-Fame Success

Today, Ian Telfer is one of Canada’s most successful and wealthiest entrepreneurs. But this wasn’t always true — Telfer was rejected from every single business school he applied to until he was miraculously accepted to uOttawa’s MBA program just 2 days before classes started. This changed everything.

Telfer finally pursued his true passion for business, made invaluable connections at uOttawa and then, by another stroke of luck, ended up in the gold mining business. He led multiple start-up ventures and navigated complicated mergers and acquisitions throughout his whole career as an executive. Telfer made history with multiple successful mining companies, including TVX Gold, Wheaton River, Silver Wheaton, Terrane Minerals, and Uranium One. He directly contributed to their total market capitalization of over $50 billion. The World Gold Council, which comprises members of the world’s leading gold mining companies, elected Ian Telfer as Chairman. He held the role for 4 years, forever cementing his gold status in the world of mining.

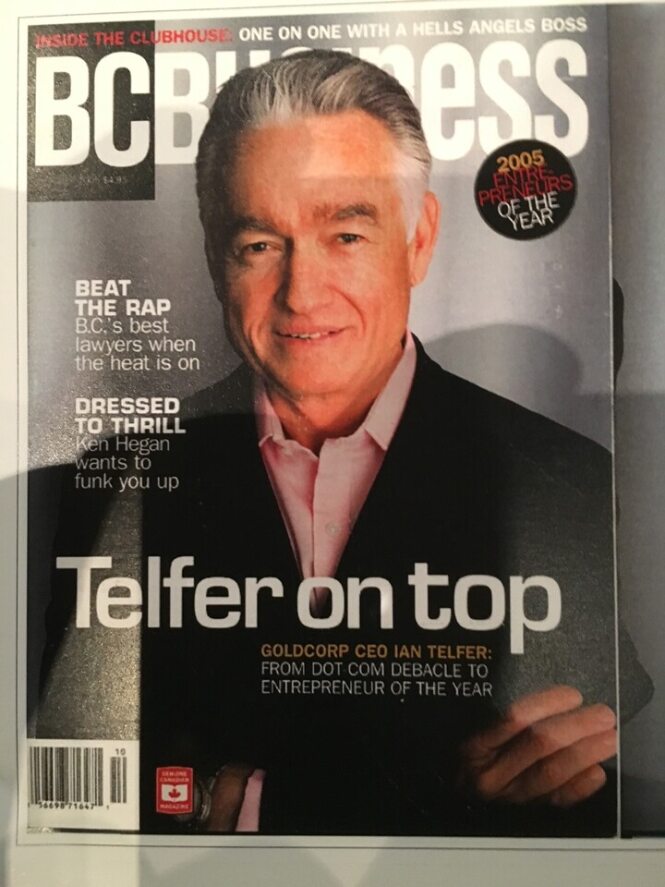

For his remarkable business prowess, The Canadian Mining Hall of Fame inducted Telfer in 2015, and the Canadian Business Hall of Fame followed in 2018. Ernst & Young named Telfer Western Canada’s Entrepreneur of the Year in 2007. Telfer received an Honorary Doctorate from uOttawa in 2015 and is a member of the Telfer School’s Strategic Leadership Cabinet. He was also involved in Destination 2020 Campaign Cabinet.

Telfer’s Transformational Gift of 2007

Does the name sound familiar? The Telfer School of Management is proud to share Ian’s last name. In 2007, Telfer made history, donating $25 million to the School, the largest sum gifted to a Canadian business school at the time, exceptionally by an alumnus. Since then, Telfer donated an additional $2 million in 2015. In 2022, marking 15 years since his transformative gift, Ian commemorated the occasion by presenting his $750,000 22-pound gold coin for the ceremonial toss at the 2022 Panda Game homecoming, later donating its value to the School. Since 2007, Telfer has sponsored scholarships for Telfer students with lower marks as a nod to his bad grades in university.

Telfer’s philanthropy is far and wide, including support for the Lions Gate Hospital Foundation in British Columbia, the province the Telfer family has called home for decades. Ian Telfer and his wife, Nancy Burke, have supported West Vancouver’s Collingwood School, The Vancouver Aquarium, The Special Olympics, and the Simon Fraser Goldcorp Centre for the Arts throughout the years. In 2014, Telfer donated $500,000 to The Princess Margaret Cancer Foundation. He also served as the Director of the Special Olympics Canada Foundation.

For Ian Telfer’s extraordinary business success and inspiring dedication to philanthropy, we are honoured to award the alumnus with the R. Trudeau Medal, recognizing Telfer’s continued and unprecedented support of the School. This is the highest honour an alumnus can receive from the School of Management. The Award was established in 1989 in honour of the University of Ottawa Commerce Director, Roland Trudeau, who served the School for 15 years. This achievement recognizes outstanding contributions to the business world, the community, the School, as well as tremendous leadership and initiative. We are bestowing the medal upon Ian in conjunction with the Meritas Tabaret award from uOttawa.

We sat down with Telfer himself for an exclusive interview to learn more about the shiny business of gold mining, how networking and relationships took Ian to great heights in his career, and which books he is reading right now.

Ian Telfer: “My uOttawa MBA changed my life”

Ian Telfer’s family moved to Canada from Oxford, England when Telfer was only two years old. His Scottish father worked as a Royal Air Force pilot before becoming an accountant, and his Canadian mother was a schoolteacher. The family first lived in his mother’s native Moose Jaw, Saskatchewan before relocating to Toronto where Ian grew up and then studied.

Telfer attended the University of Toronto, which he “barely got into” due to failing Grade 13, and graduated with a Bachelor of Arts in Political Science and Economics in 1968. “Once I graduated from U of T, I struggled for five years,” adds Ian in an interview. “It was when I got into uOttawa that my life started to make more sense.”

In these five years, Telfer sold life insurance, pharmaceuticals, and even university textbooks. Something wasn’t adding up for the entrepreneur-to-be: “I hated my job, I hated my life”. Telfer sensed the winds of change upon him. He quit his job and decided to go back to school to pursue his passion for business and entrepreneurship, something he was always inclined towards. But it wasn’t so easy.

Due to poor grades in his undergrad, Telfer was rejected from every MBA program in the country, including the one at uOttawa (back then the Telfer School was still called the Faculty of Management Science).

As chance would have it, uOttawa reached out to Telfer just two days before classes started, offering him the very last spot in the program (and mentioning he had “the worst marks ever for a graduate student”). In his own words, “This changed everything.” Accepting the challenge, Telfer worked really hard and even secured a scholarship into the MBA program.

To this day, Telfer remembers his days at the School with gratitude and fondness: “At uOttawa, I was studying business, something I actually had an interest in, surrounded by people with work experience in both government and industry. We had a lot in common to talk about. The faculty were very focused on teaching us, but also guiding, encouraging, and motivating; everything that should happen in a graduate program. It worked out very well for me.”

The MBA program kicked off Telfer’s journey in business, but it wasn’t all smooth sailing after graduation — this was only the beginning.

Trials and Tribulations, Starts and Failures: Ian Telfer’s Early Career

Telfer’s career put the entrepreneur through the wringer before he finally found lasting success — first, he had to survive a dot com bust, bankruptcy, and tanking gold prices.

A little luck along the way helped. In a 2011 interview, Telfer reflected on his career: “Financial success is like being struck by lightning; it’s pure happenstance. Many people work hard and have great visions, but the stars really have to line up.” It took a minute for them to line up before Telfer struck gold, but the opportunities began with the last-minute admission to the MBA program.

After he graduated, Telfer followed in his father’s footsteps by earning the Chartered Accountant designation. Armed with his newly minted CPA, Telfer got his start in the industry at Hudson Bay Mining (HBM) as a financial analyst, where he learned all the essentials of the tricky business. Following a path of lucky chances, this was yet another “coincidental opportunity” that lit up Telfer’s long-term interest in mining.

With a life-long interest in entrepreneurship, Ian was itching to leave public accounting after a few years but had no long-term plan for his future. Yet, out of all the precious metals he came in contact with at HBM, something about gold mining specifically awakened his entrepreneurial spirit. In a 2005 interview, he said, “Gold is unique because it has an emotional quality. Also, gold stocks trade at much higher valuations than any other industry in the world, based on cash flow, earnings and the lifetime of the business. I like that.”

In 1983, Telfer became the CEO of his very first company, TVX Gold, which he founded with Hudson Bay Mining colleagues. Telfer moved to Rio de Janeiro, Brazil, to capitalize on the gold rush momentum taking South America by storm in the 1980s and spent the next six years there.

After a few years at the company, Telfer left TVX Gold and relocated back to Canada with his wife and two young children. TVX Gold was later acquired in a merger with another gold mining company. In the 1990s, Telfer formed his second venture, Vengold Inc. But right after Telfer led the company to buy gold mining shares from the government of Papua New Guinea, the price of gold tanked and the company was left with more debt than equity. Thankfully, Telfer capitalized on a short uptick in the price of gold to pay off his line of credit to the banks. Only a shell of a company was left — a $30 million shell, that is. At the cusp of the new century, Telfer converted Vengold into a dot-com Internet incubator venture, jumping on the Internet bandwagon. But, all that glitters is not gold. The company didn’t prove to be successful and went bankrupt in 2001, following the dot-com bubble burst.

The Godfather of Gold Mining

Not one to give up, Telfer’s dedication to gold mining remained unwavering. A brief foray into tech didn’t discourage Telfer whatsoever, even though the entrepreneur had to sell his house in West Vancouver and move into a rental, still supporting his young family. But, yet another opportunity presented itself to Ian — that same year, Telfer joined a mining financier Frank Giustra in returning to the gold market by buying into a company called Wheaton River Minerals. In a three-year stint as the CEO of Wheaton River, Telfer led the company from being valued at $10 million to $2.4 billion with strategic purchases of gold mines and a lucky rebound in gold prices.

In 2004, at the peak of Telfer’s Wheaton River success, the company was absorbed by Goldcorp Inc. in a merger. Telfer became the CEO of Goldcorp and held the title for two years until another merger which pronounced Goldcorp as the world’s third-largest gold mining company. Telfer took on the role of Chairman instead. At one point in Telfer’s career, Goldcorp became the world’s most valuable gold mining company and hit a market cap of $50 billion. Telfer recalls how at the beginning, Wheaton River only had six employees and after the merger with Goldcorp, the company was now at 20,000 employees. During the same time period, Ian was also the Director of Silver Wheaton Corp and led the separation of the silver subdivision from the rest of the company.

And that’s not all: in 2006, Telfer created UrAsia Energy, a company specializing in producing uranium, with the aforementioned mining financier Giustra. Telfer was the Chairman of UrAsia and led the company through a merger with another industry leader, retaining his title in the process. The incredibly driven entrepreneur also helped launch Primero Mining, Peak Gold, Terrane Minerals, and Tahoe Resources. On top of that, he co-founded Renaissance Oil Corp, of which he is still the major shareholder and serves as the Director of the company. Telfer served as the Chairman of the World Gold Council between 2009 and 2013.

When inducted into the Canadian Business Hall of Fame, Telfer was recorded in a short film played at the ceremony. In the film, he described himself “as a gold bug, fascinated by gold’s mythic qualities,” someone who doesn’t fear failure and likes to create businesses.

Sharing the Spoils: What Motivated Telfer to Keep Going

On the surface, it’s easy to see how Telfer’s illustrious career and strategic business decisions made him a multimillionaire. But for the driven entrepreneur who endured his own share of struggles, money isn’t everything. There are more altruistic reasons behind Telfer’s continued dedication to gold mining. First, he is proud to work in an industry where Canada is a leader: “Around the world, Canada is highly respected for its experience and regulation in mining. There are very few industries where Canada is at the top of the heap when it comes to international competition,” explains Telfer. “I didn’t realize this would be a factor when I first got into mining, but as I operated in Australia, Chile, Papua New Guinea, and the US, I saw first-hand that Canadians bring mining technology, education, and knowledge to developing countries and remote areas which is highly regarded by governments all over the world,” adds Ian.

While new mining technology is simply a part of the business, it’s the aspects of education and resource-sharing that inspire Telfer to this day. “For the last forty years, as I’ve been building mines in both developing and developed countries, you realize how a well-run and well-organized mining operation in a remote area has huge benefits,” explains Ian.

The entrepreneur is as focused on the economic development of the area and the country in which he operates, as on the bottom line. “When building mines, we’d build hospitals and schools, churches and roads, housing and electricity, and we’d supply fresh water. I love that part about the business,” shares Telfer. Happy with the positive impact his companies can have on the local communities, Ian always prioritizes the economic developmental aspect.

“In just one example, in Papua New Guinea, when I visited the mine site on a remote island for the first time, there was only a shack,” recalls Telfer. “Once we found gold and developed the mine, we invested a billion dollars back in the community, leaving the island with a newly built village, airport, and roads, dramatically improving the lives of the people who live and work there.” Throughout a 40-year career, there are many more stories of changed lives: between 2002 and 2019, Goldcorp gave more than $100 million to charity causes, under Telfer’s guidance. This impact could only be possible with support from others in Telfer’s career and that’s where relationships played a huge role.

The Importance Networking Played in Telfer’s Success

Telfer navigated many a merger and acquisition. He had to make quick decisions, win the trust of shareholders and secure investments in his many businesses. While a natural talent for business plays a role, so does Telfer’s charm and charisma when it comes to working with people. “Your network is much more important than people realize,” says the entrepreneur. Recalling the time he lived in Brazil for six years, he remembers an expression he learned from Brazilian people: “Deals are made by people.”

“When you read about M&A in the paper, the numbers make sense and play a role, but at the end of the day deals are made by people,” says Telfer. “I enjoyed working with other mining companies and they trusted me as a partner with my share of financing. Because of the risks in mining, joint ventures are very common and I had a lot of them with the 5 biggest mining companies in the world. We treated each other well and had good relationships.” Telfer’s secret to success? Cultivate trust, treat people well, and nurture your connections.

How Ian Telfer Made the uOttawa Telfer History

After (literally) digging for gold paid off for the businessman, he decided it was time to give back to the place that “kickstarted everything” and repay the favour. It all began with a cold call from the School in the 1990s asking Telfer to help set up a $5,000 endowment fund for a scholarship in his name. He decided to the scholarship should go to an MBA student with the lowest marks.

In 2005, inspired by the TV programme The Apprentice, Ian decided to invite a uOttawa MBA graduate student to apprentice under him in his role as the CEO of Goldcorp. Running the program for two years, this was one of the first many opportunities Telfer gave back to the University, with both “apprentices” still working in the mining business to this day.

Then in 2007, came the biggest change of all: “After some talks, the Dean at the time, Dean Kelly, approached me and said the school was considering naming the facility and would I be interested. Of course, I was flattered but there was no way I could afford it,” recalls Telfer in his classic humorous tone about the conversation that took place sixteen years ago.

Eventually, all the pieces fell into place and Telfer donated a transformational gift of $25 million to give back to the place that gave him his start in business. To honour the successful alumnus entrepreneur, the School of Management was named in Telfer’s honour. “I applied to every business school in Canada and they all turned me down until uOttawa reached out again. I think students at the School know my bad undergraduate marks and we thought it’d make for a great story,” adds Telfer.

In a uOttawa interview, Telfer also shared about the importance of the gift to himself: “That donation has one of the most important things I did in my whole life because it’s allowed me to meet so many people and learn so much,” he added. “It's helped the school and it's just been an incredibly positive experience all the way around. I can't say enough good about it.”

To date, Ian Telfer has given more than $30 million to the School, with the funds supporting student experience and going towards scholarships.

Why giving back is a non-negotiable to Ian Telfer

Telfer continues to actively support the School of Management to this day. But he is also passionate about supporting healthcare and the arts with his philanthropic efforts together with his wife Nancy Burke. In a 2011 interview, Telfer said that because he didn’t expect any of his financial success, to give a huge percentage doesn’t seem like that big of a sacrifice.

Throughout the years, the Telfer family has generously given to the Collingwood School, Lions Gate Hospital Foundation, the Vancouver Playhouse, and multiple arts and culture causes. In 2022, Ian Telfer and his wife Nancy Burke donated $7 million to the University of Toronto’s Faculty of Music, in honour of Telfer’s late brother, Jay Telfer, who was a screenwriter and musician. The couple also started Fernwood Foundation which focuses on giving to healthcare and education causes, named in honour of the first street they lived on in Toronto.

“There is an infinite amount of excellent causes out there that are always looking for help. You tend to consider causes you have a connection to. It’s a personal or an institutional connection,” shares Telfer about his philanthropy philosophy.

Lessons from 50 years in the corporate elite

Today, Telfer has a piece of advice or two to give to current Telfer students. The first is to not ignore your own instincts — if you are considering a career change or a move, if it doesn’t feel right in your gut then don’t do it. “When you are young, you tend to listen to relatives, lawyers, successful people around you and underestimate your own feelings and abilities,” says Telfer. Trust your gut feeling and follow good vibes.

In the same vein, Telfer shares one of his coined expressions: “Red flags never go down.” He cites a common example in business: when a company spends a lot of time and money hiring someone and then early on, a red flag goes up, the business often keeps the person around because of all the resources already invested, not wanting to admit a mistake was made. The management thinks they can coach the new hire, motivate them, or incentivize them to change their behaviour, but it never works. At some point, the person is let go and it’s harmful to everyone: the person spent too long in the wrong institution and the business spent too many resources on the wrong hire. “When something goes just a little off, notice that,” adds Telfer. “The red flags only add up. Act right away.”

100 countries and weekly book club: what’s next for Telfer

While Telfer undoubtedly learned countless valuable lessons in his 50-year career, he continues to learn from others by reading. Always an avid book lover, Telfer has been known to read a book a week: “I read a lot. Mainly non-fiction, about success and failure. I read most books on startups, who started it, and why it worked, whether that’s Uber or Netflix or WeWork, I learn something from all of them.” Right now, the mostly-retired entrepreneur is reading about HBO and he recently read a book on creativity by music producer Rick Rubin, The Creative Act: A Way of Being, which Telfer recommends to anyone who has to create something in their mind and break through the writer’s block.

Bit by the travelling bug with the first venture into sunny Brazil forty years ago, Telfer has since visited more than 124 countries and counting. He enjoys spending his time seeing how the countries are governed and how the people are being treated: “Once you go to 124 countries, Canada looks better and better,” adds Telfer. “I get a little upset that so many Canadians don’t realize how lucky they are. We are very, very lucky to have the governments and regulations that we do.”

As for his one must-do vacation? It’s a wild game safari in Africa, without a question. “I’ve seen about every other tourist site in the world. This experience was visceral, you could feel this is where our roots are,” says Telfer. The entrepreneur is planning to revisit a few countries in Africa as soon as this fall, exploring new investment opportunities and continuing to work, travel, read, spend time with his family and play golf in the meantime.

Wrapping up our conversation, Telfer wants to thank his wife of 47 years, Nancy, for her support throughout the executive’s career. The couple has two children and six grandchildren together. In his final piece of advice, Telfer encourages us all to find the same kind of love: “If you meet someone in your 20s and you’re still together 50 years later, a lot of that is just pure luck. When you’re 20, you don’t know much about much and if you happen to run into someone you could grow with, I think that’s a miracle. I encourage everyone to look for that, and trust your gut.”

We at the Telfer School of Management are beyond proud to call Ian Telfer an alumnus of the school. We look forward to continued collaboration and can’t wait to see what the godfather of gold mining will do next.