What do Queen’s, Cornell, Princeton, Columbia, Peking and the London School of Economics all have in common? These are just some of the schools who were surpassed by Telfer’s team in the 2015 Rotman International Trading Competition (RITC). Following an intense two days of competition (Feb. 20 – 21), among 50 different teams from across the globe, Telfer’s team emerged 9th. This is all the more impressive considering that the competition was largely made up of graduate-level students in finance and quantitative engineering.

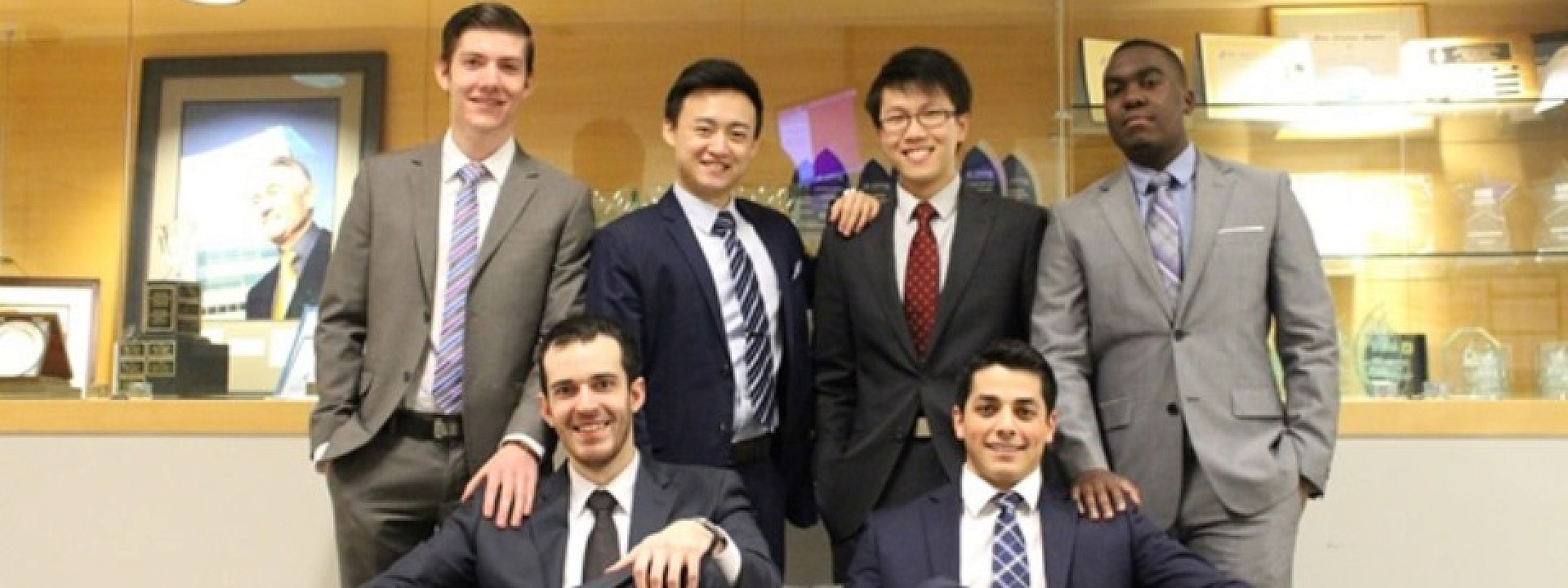

This year’s team consisted of six of our highest-performing finance students: Ian Harten, Cassy Aite, Malanga Mposha, Ethan Zhang, William Tu and Daniel Shannon and coached by Pouya Safi, the Manager of the Financial Research and Learning Lab. The team was formed following their exceptional performance at the Telfer Trading Competition in October. Since then, the team had been meeting regularly to devise their strategies and practice on the RIT software. Anyone passing the Financial Research and Learning Lab was likely to have seen these team-mates preparing for the competition. This preparation only became more intense as the competition approached. By the time reading week had started, RITC team members could be found practicing round the clock. Even on the train ride down to Toronto, the team continued to fine-tune its strategies.

RITC is an annual competition that pits teams of finance, economics and mathematics students against one another in six intense competitive events.

First among them was the BP Commodities case. Here team members were assigned roles as traders, producers or refiners. The team had to work together to interpret market signals and trade various petroleum commodities and futures contracts.

The Optiver Options case, in which the team finished 9th, had the team analyze market data to trade different call options on a fictitious exchange-traded fund. Competitors devised a model that collected, interpreted and modeled this data and devised a strategy to successfully trade on this model’s data.

The Sales & Trading case, in which we finished 10th, required participants to take on the role of a trader and make rapid evaluations of liquidity risk. Throughout the case, the traders had to assess the value and risk level of dozens of tender offers and execute trades on the positions gained through these tender offers. Success was determined by the team’s ability to manage its market exposure while exploiting market-making opportunities.

The S&P Capital IQ Equity Valuation case consisted of building a discounted cash flow model for four companies. As news items were released during the competition, updates had to be incorporated in to the model. As these new data emerged, players traded all four stocks to exploit possible market mispricing.

The Algorithmic Trading cash, in which the team finished 9th , focused on the development of a trading algorithm that would analyze market data and trade on that data, all while avoiding market penalties. Requiring a tremendous amount of preparation, this case was carried out by a single team member, Ethan Zhang, sequestered in a closed room.

The most colourful competition was definitely the Quantitative Outcry Case, in which Telfer placed 2nd. This involved two team members acting as market analysts and incorporating market data in to a model of four countries’ GDP in order to price a market index. This estimate was then transmitted via silent hand signals to two other team-members working in an open-outcry trading pit. These players, dressed in bright costumes to make themselves more visible to the analysts, bought and sold based on the analysts’ instructions.

This was only the second time for Telfer to participate at the competition, and they saw a huge improvement from last years’ 40th place finish. The practice, hard work and dedication played an instrumental role. Those on the team that are not graduating are already thinking about next year’s competition. However, no one is guaranteed a returning spot, they must all earn their spot next year. The bar is set high for a top 5 finish in 2016. A special thanks also goes to the Telfer Marketing Department, SFUO and Career Centre for their help in funding the expenses of attending the competition.