The first Telfer Trading Competition took place March 22, 2014 and consisted of an all-day event hosted by Pouya Safi, the Manager of the Financial Research and Learning lab and one of his Lab Assistants, Alex Tyutyunnik. Twenty plus students registered for the event which consisted of a Social Outcry using a proprietary excel macro created by Alex Tyutyunnik of Telfer, and two simulation based cases using the Rotman Interactive Trader software which was recently acquired to complement the Financial Research and Learning Lab. Competitors could either choose to compete individually or in pairs. Upon registration students would receive details on how to download the software and how to access a sample case in order to familiarize themselves with the system. Tutorials were provided in advance of the competition to any students that were interested. The two actual cases, one on arbitrate trading and one on commodities went live on Wednesday before the competition. Competitors were encouraged to formulate a strategy and modify the VBA based spreadsheet to suit their needs and create their buy and sell signals.

The event kicked-off by a brief intro and outline of the day and quickly moved onto the Social Outcry competition. In this portion, students competed individually to gain the highest profit based on the Telfer-500 index, a highly volatile index which simulated 30 days of trading in 20 minutes. The price moved based on news releases that would appear on screen alongside the candle-stick chart. Competitors would yell their bid and ask prices and trade between themselves. The atmosphere was quite exciting as students ran around and mimicked a stock trading floor of old times. Following this event, lunch was served and the competitors moved onto the case based section of the competition. The two cases consisted of an Arbitrage case and a Commodities case. The Arbitrage case consisted of 5 rounds of 5 minutes each and students were required to find arbitrage opportunities due to mispricing between two securities and an index consisting of only these two securities. The commodities case consisted of 2 rounds of 30 minutes each and competitors were required to trade natural gas futures based on news and economic news releases. Many students created their own excel spreadsheet which would calculate inherent mispricing for the arbitrage case and pricing of the futures contracts based on inputs from the news.

Overall winners of the competition were determined using a ranking system in order to minimize speculation profits and encourage those who underperformed in one round. For example, a student who consistently placed in the top five would fare much better overall than a student ranking first in one round and last in the next.

Students were able to see theoretical concepts they've been learning in their finance courses and how they apply in a simulation environment. Adding experiential learning opportunities like these really help strengthen core understanding of our students, better prepare them for real-life scenarios as they enter the job market and give them the best possible student experience while attending the University of Ottawa. The common feedback from students was to see more simulation based cases related to their courses, and to continue to have events like these while opening registration up to students from around the Ottawa region. The Financial Research and Learning Lab is quite excited to start organizing our second Telfer Trading Competition, one that is much bigger and also helps start our preparation for the largest trading competition in the world, the Rotman International Trading Competition.

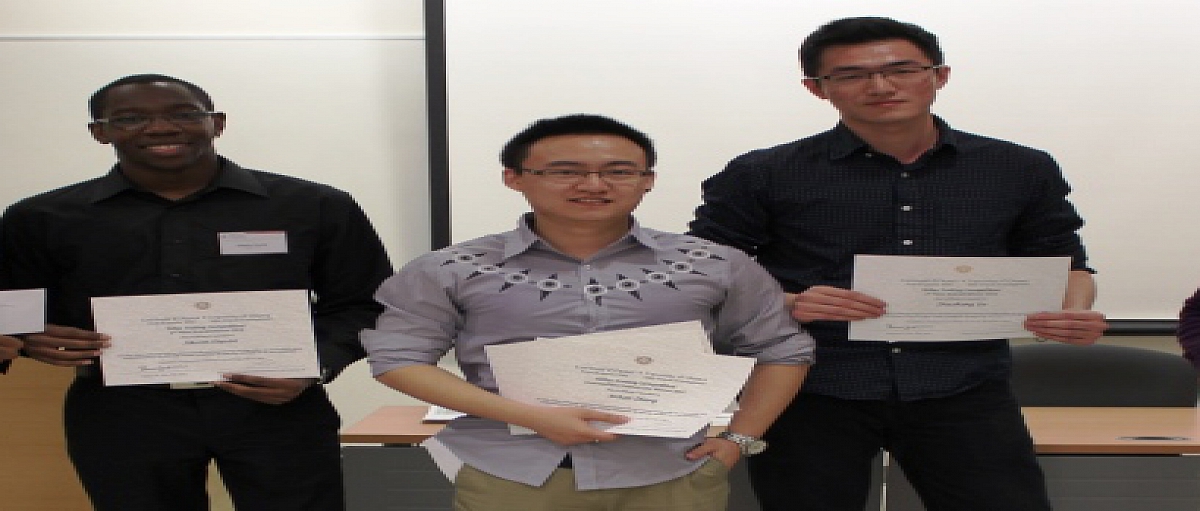

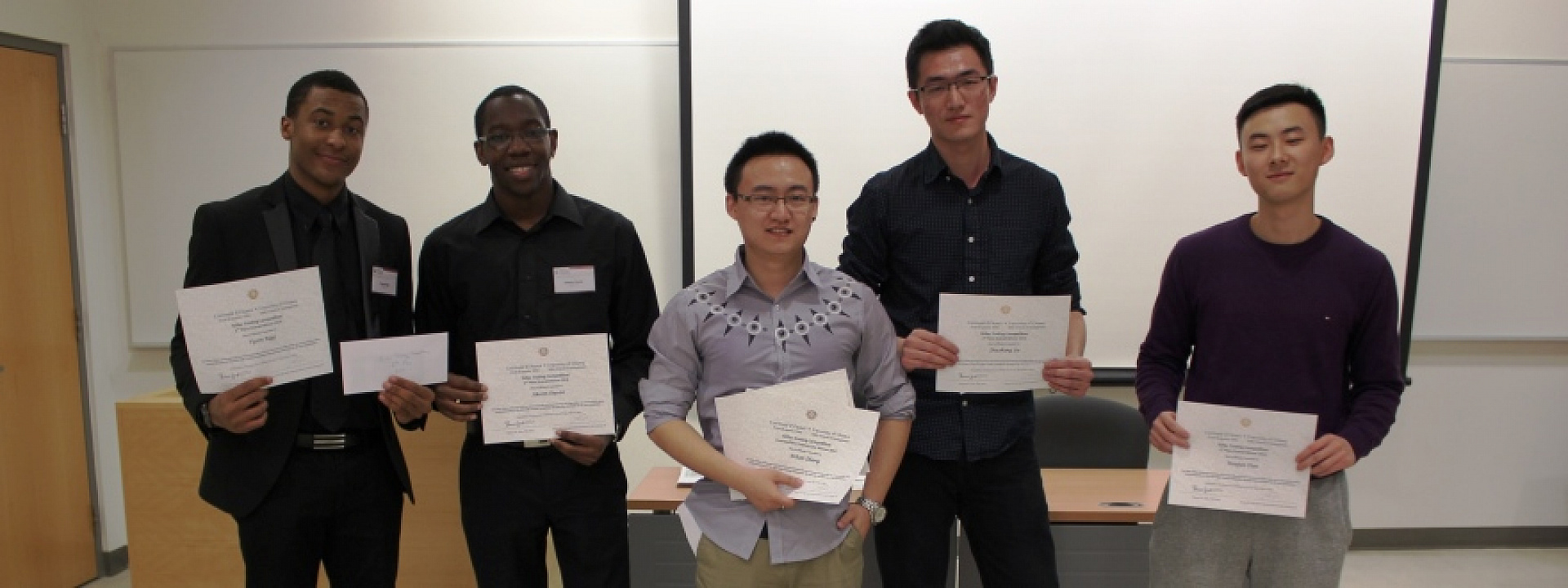

The day's winners were as follows:

Overall:

- Ethan Zhang

- Tyson Rigg and Akeem Daniel

- Wenjun Tian and Zhuohang Yu

Social Outcry Winner: Cassy Aite

Arbitrage Case Winner: Ethan Zhang

Commodities Case Winner: Ethan Zhang