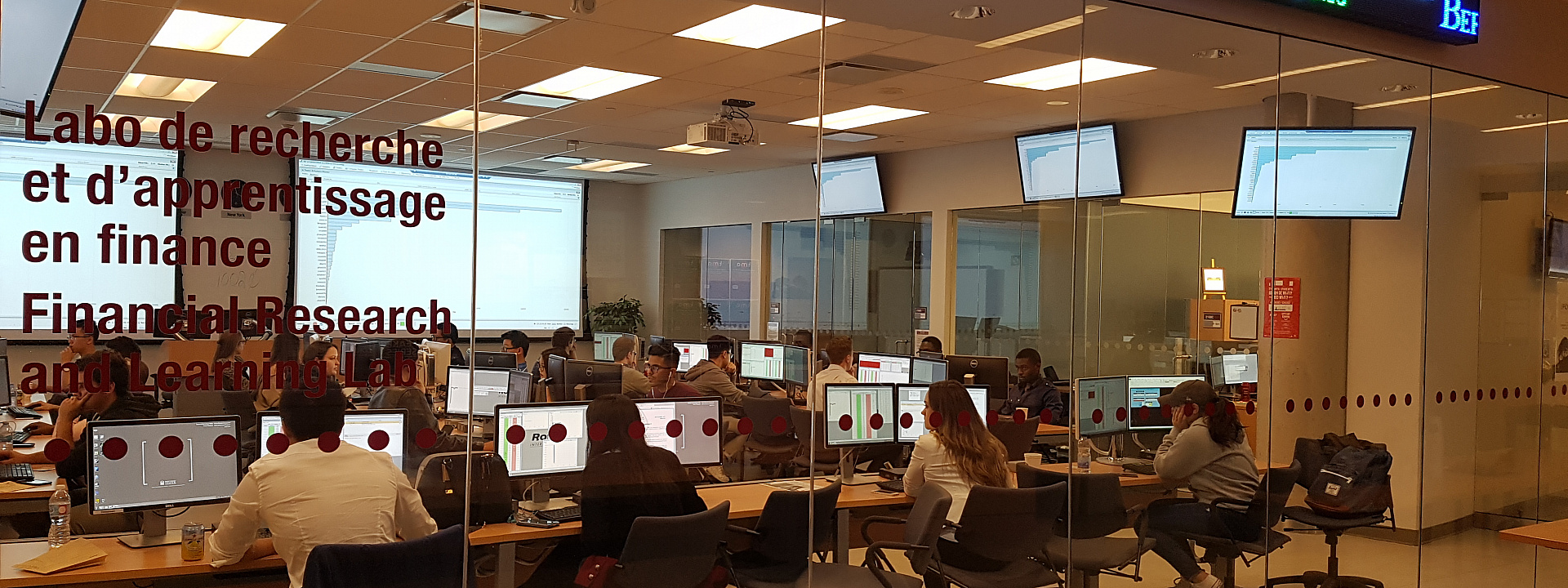

The 6th Telfer Trading Competition (TTC) was held on Saturday, October 1, 2016 and continued to build on its legacy as one of the most anticipated competitions and events of the year. The competition consists of about 100 students from 1st to 4th year who are looking to take part in friendly, faced-paced trading competition which helps enhance their student experience. It’s also an opportunity for like-minded individuals to meet each other and compete in a simulated environment designed to mimic real-life trading scenarios. For the second year, students from Telfer’s Financial Theory class (ADM2352) were encouraged to participate in order to apply the theory they learn in class and earn some additional bonus grades. The TTC is organized and hosted by the school’s Financial Research and Learning Lab, which is a state-of-the-art teaching and learning facility with leading industry standard software and databases such as Bloomberg, S&P Capital IQ and WRDS.

The competition consists of two parts, an ice-breaking Social Outcry competition and computer based case simulations which uses the order-driven Rotman Interactive Trader (RIT) platform. The Social Outcry tries to mimic olden day trading pits where individuals are required to buy and sell shares of the Telfer 500 Index (a simulated market) that is driven by news items appearing at various intervals. Just like actual markets, news is interpreted differently by the 100 traders who make the experience a fun, loud and fierce environment.

After students have had a chance to meet each other during the Social Outcry in the Camille Villeneuve Room, they move down to the Financial Research and Learning Lab in order to compete on 5 different cases exploring different financial theories: Liability Trading (2), Options, ETF Arbitrage, and Equity Valuation. Students competing at the TTC get access the cases 2 weeks in advance and have the opportunity to create their strategies for each case. Many students build complex financial models and macros which completely automates their decision making. During the competition, each case is run 3 rounds in order to reward consistency of strategy over speculation. The tension in the room can be cut with a knife as students focus on generating consistent profits and avoiding losses. Since all traders in the room affect liquidity in the rounds, at many times the room bursts in uproar from a potential manipulation by a competitor. This generally causes a sudden market spike, which only enhances the dynamic environment and feel of a trading floor.

After a full-day of competing (noon to 6:00 p.m.), students made their way back to the Camille Villeneuve Room for a well-deserved dinner while the results are tabulated. Cash prizes are awarded not only to the top 3 finishers, but also for each of the 5 cases and Social Outcry.

The TTC is also the method used to select the team for the prestigious Rotman International Trading Competition, which is an annual invite-only competition held in Toronto each February. The RITC is the world’s largest trading competition and includes 50 teams from the best schools around the world (Columbia, Princeton, Queens, Western etc.). The parameters of the RITC is similar to that of the TTC and as such those that perform well at the TTC make good candidates. Those that finish in the top 12th get invited to apply to the Telfer RITC team in hopes of representing Telfer on the international stage.

The 6th Telfer Trading Competition was again a huge success, and continued to build its reputation as one of the school’s best and toughest competitions. Events like these help give students of all years a chance to dive deeper into applying theory into practice, learning new skills, and understanding the financial industry a bit better. A big thank you to the Financial Research and Learning Lab, its lab assistants and volunteers for organizing and running this event, as well as the Telfer Marketing Department and Capital Markets Society (CMS) for sponsoring it. As we close out this iteration of the TTC, we look forward to a successful showing at the Rotman International Trading Competition as well as continuing to grow the TTC.

Overall Rankings:

- Dmitry Shorikov

- Roma Stepanchenko

- Tsoi (Jack) Yuen Lau

- Danika Fu

- William Tu

- Evan Friend

Case Winner:

Social Outcry: Tsoi (Jack) Yuen Lau

Liability Trading 3: Tsoi (Jack) Yuen Lau

Liability Trading 4: William Tu & Beau Keppler

Options: William Tu, Dmitri Shorikov & Tsoi (Jack) Yuen Lau

ETF Arbitrage: Tsoi (Jack) Yuen Lau

Equity Valuation: Aleksa Milosevic