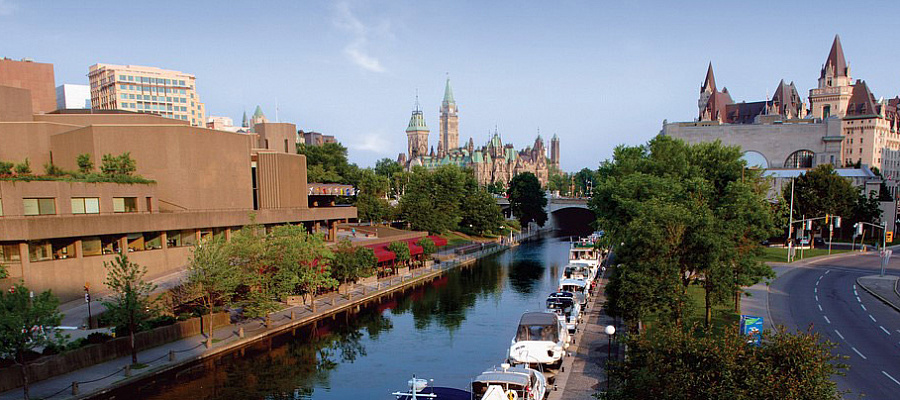

2018 Quantitative Risk Management & Financial Analytics Workshop

(En anglais seulement)

It is our pleasure to invite you to this workshop event jointly organized by the Telfer School of Management and the Department of Mathematics and Statistics at the University of Ottawa.

The finance industry has recently been undergoing a major technological transformation driven by the development of new analytics solutions. In particular, risk management as the basis of any financial activity has shifted to a data-driven regime where the use of quantitative measures has became a standard either for the purpose of internal risk control or external risk regulations. The core of these analytical solutions and quantitative methods is the novel design and use of statistical and optimization algorithms, which enable complex datasets to be analyzed in the search for a better solution. New developments along this line can be found across disciplines. The aim of this workshop is to bring together researchers working to improve analytical solutions and practitioners who deal with challenging financial and risk management problems and seek better solutions.

The list of topics to be covered during the workshop includes, but is not limited to

- Quantitative risk management: concepts, techniques, and tools,

- Optimization in finance and risk management,

- Statistical (Machine) learning in finance and risk management,

- Data analytics in finance and risk management,

- Portfolio optimization

- Risk measurement and hedging

- Modeling of financial derivatives, asset management, capital budgeting, etc.

The workshop consists of 1) distinguished lectures by leading academic and industrial researchers and practitioners, 2) contributed talks on recent research advances.

Invited Speakers

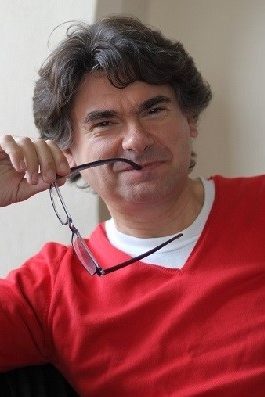

Thomas F. Coleman

Ophelia Lazaridis University Research ChairProfessor, Combinatorics and Optimization, University of Waterloo

Director, Waterloo Research Institute in Insurance, Securities and Quantitative Finance (WatRISQ)

Fellow, Society for Industrial and Applied Mathematics (SIAM)

Title : Learning Minimum Variance Discrete Hedging Directly from the Market.

Professor Thomas F. Coleman holds the Ophelia Lazaridis University Research Chair at the University of Waterloo. The focus of this chair is on the design of efficient optimization methodologies targeted to a variety of scientific and industrial applications.

Professor Coleman also heads the research effort at the Global Risk Institute. In 2010-2011 Coleman served on the “oversight committee” to establish the new Canadian national institute, the Global Risk Institute in Financial Services (GRI), a not-for-profit private/public organization. He chaired the GRI subcommittee, the Research Structure Committee, to establish the research mandate/framework for GRI.

From 2005 to 2010 Coleman served as the dean of the Faculty of Mathematics at the University of Waterloo. This Faculty of five departmental units consists of 200 faculty members, 5000 undergraduates, close to 1000 graduate students. During Coleman’s tenure as dean, the Faculty of Mathematics acquired funds for, and began the construction of a new Faculty building (Math 3), became a founding member of a new UW campus in the UAE, established outreach offices in Toronto and Shanghai, developed numerous international partnerships, and, with the support of the Bill and Melinda Gates Foundation ($12.5M), greatly expanded the high school reach of the Centre for Education in Mathematics and Computing.

Prior to 2005 Coleman was a professor of computer science at Cornell University; he was a faculty member in the Computer Science Department at Cornell University for 24 years, 1981-2005. In the period 1998-2005 he was also the director of the Cornell Theory Center (CTC – a supercomputer applications center) which received major support from numerous technology companies, primarily Microsoft. He was chair of the SIAM Activity Group on Optimization (1998-2001). During his tenure as CTC director, Coleman founded and directed CTC-Manhattan, a computational finance academic-industry-government venture located at 55 Broad Street in New York.

Coleman is the author of four books on computational mathematics, the editor of six proceedings, and has published over one hundred journal articles in the areas of optimization, automatic differentiation, parallel computing, computational finance, and optimization applications. Coleman is currently on the editorial board of several professional journals. Coleman had developed, with colleagues, both freely-available and commercial software for optimization use and application. In 2016 Coleman became a fellow of the Society for Industrial and Applied Mathematics.

Coleman also heads a boutique consulting/solutions company, Cayuga Research Inc., working with industry clients on predictive optimization applications (application areas include: health and medicine, climate change, logistics and shipping, finance and banking, insurance fraud detection).

Matt Davinson

Professor, Statistical and Actuarial Sciences, Western UniversityDirector – School of Mathematical & Statistical Sciences

Fields Institute Fellow

Title: Where Data Science meets the Dismal Science

Henry Lam

Associate Professor, Department of Industrial Engineering and Operations Research,Columbia University

Title: Robust Extreme Risk Analysis

Luis Seco

Professor, Department of Mathematics, University of TorontoDirector, Mathematical Finance Program

Director of RiskLab Toronto

President and CEO Sigma Analysis and Management

Title: Postmodernism in Finance: The Mathematics of Management Fees

Conference Program

8:30 am – 8:50 am – On site registration and coffee

8:50 am – 9:00 am – Welcome and Introduction

9:00 am – 9:50 am – Keynote Speaker (Thomas F. Coleman)

10:00 am -11:15 am – Contributed sessions (25 minutes each)

- Speaker: Xiangjin Shen (Senior Economist, Financial Institutions Division, Financial Stability, Bank of Canada)

Title: Joint tail risk analysis by the Vine Copula - Speaker: Jun Cai (Department of Statistics and Actuarial Science, University of Waterloo)

Title: Risk measures based on the behavioural economics theory - Speaker: Marcos Escobar-Anel (Department of Statistical and Actuarial Sciences, Western University)

Title: Robust Portfolio Choice with Derivative Trading in Continuous Time.

11:15 am – 11:40 am – Coffee break

11:40 am – 12:30 pm – Keynote Speaker (Matt Davison)

12:30 pm – 2:00 pm – Lunch break

2:00 pm – 3:15 pm – Contributed sessions (25 minutes each)

- Speaker: Jorge Cruz Lopez (Principal Researcher, Funds Management and Banking Department, Bank of Canada)

Title: Residual Risk and Default Waterfalls in Central Counterparties - Speaker: Maarten van Oordt (Senior Analyst, Financial Stability Department, Bank of Canada)

Title: Systemic Risk and Bank Business Models - Speaker: Gareth Witten (Executive-in-Residence, Global Risk Institute, Toronto. Professor. Sugnet Lubbe, Department of Statistics and Actuarial Science, University of Stellenbosch, South Africa.)

Title: Visualizing variables in Covariance Analysis with biplots: applications in risk management

3:15 pm – 4:05 pm – Keynote Speaker (Henry Lam)

4:05 pm -4 :30 pm – Coffee break

4:30 pm – 5:20 pm – Keynote Speaker (Luis Seco)

5:30 pm – 7:30 pm – Networking Reception – 12th Floor, DMS 12102

Organizing Comitee

Rafal Kulik, Department of Mathematics and Statistics, University of Ottawa

Jonathan Yu-Meng Li, Telfer School of Management, University of Ottawa

Sponsors