Discovering how you can get into capital markets is the first step toward a rewarding career in high finance. Since many students see this as their dream, you should know that Telfer can equip you to reach your goals through different experiential learning programs, such as Microprogram Capital Markets. Learn more about this microprogram, how it can benefit you, and how to get involved.

Intro to the microprogram

Microprogram Capital Markets is a two-year specialty for Telfer students who want to work in capital markets. This program takes place during the last two years of your Bachelor of Commerce degree. During that time, you will perform tasks that develop real-life experience, which can help you land your first job in high finance. This microprogram features:

Internships in financial institutions

Workshops held by industry professionals

Trips to financial centers

Actual money management experience

Finance classes with experienced professors

Meetings with the fund management team

Why you should join Microprogram Capital Markets

Whether you aspire to work in investment banking, risk analysis or financial management, Microprogram Capital Markets will enhance your student experience by honing the different skills you need to succeed in this kind of fast-paced career. Here are the main reasons why you should participate in Microprogram Capital Markets as part of your undergraduate degree.

Gain experience in real capital markets

Microprogram Capital Markets gives you the opportunity to gain hands-on experience in managing real money, namely the Telfer Capital Fund (TCF). As is the case in all financial institutions, managing the TCF involves many different roles, each of which requires you to complete various tasks that help you progressively develop skills. Throughout the microprogram, you can expect to undertake some of the following roles:

Exploratory internship: Before the microprogram starts, during the second year of your BCom program, you complete an exploratory internship to gain a better understanding of Microprogram Capital Markets. You will get a sneak peek at the tools and connections that can help you get a paid internship during the summer before your third year of the BCom program.

Analyst: During the first year of the microprogram, you will be trained to work in a sector with a senior analyst and/or a portfolio manager. You will use data analytics to provide recommendations and develop a deeper understanding of your sector.

Senior analyst, portfolio manager and portfolio manager leader: During your second year in the microprogram, you may be a senior analyst or portfolio manager assigned to a sector. In these roles, you will have your own industry professional as a mentor and you will be responsible for pitching stocks and mentoring analysts in your sector. Additionally, two students are elected to lead the microprogram team as portfolio manager leaders. These two students run meetings, ensure quality of work for each sector, offer workshops, and liaise with professors and administrative staff.

Receive mentorship and mentor others

The professional advice and guidance provided to you when you work with a mentor can help you develop your skills. And when you mentor junior students, you gain a deeper understanding of capital markets and greater confidence. The microprogram features a multilevel mentoring approach: you receive advice and guidance from a mentor while also mentoring others. Here are the different mentorship opportunities you can expect to participate in during the program:

First-year microprogram participants mentor interns.

Second-year microprogram participants mentor first-year microprogram participants.

Industry professionals mentor second-year microprogram participants.

Visit offices in financial hubs

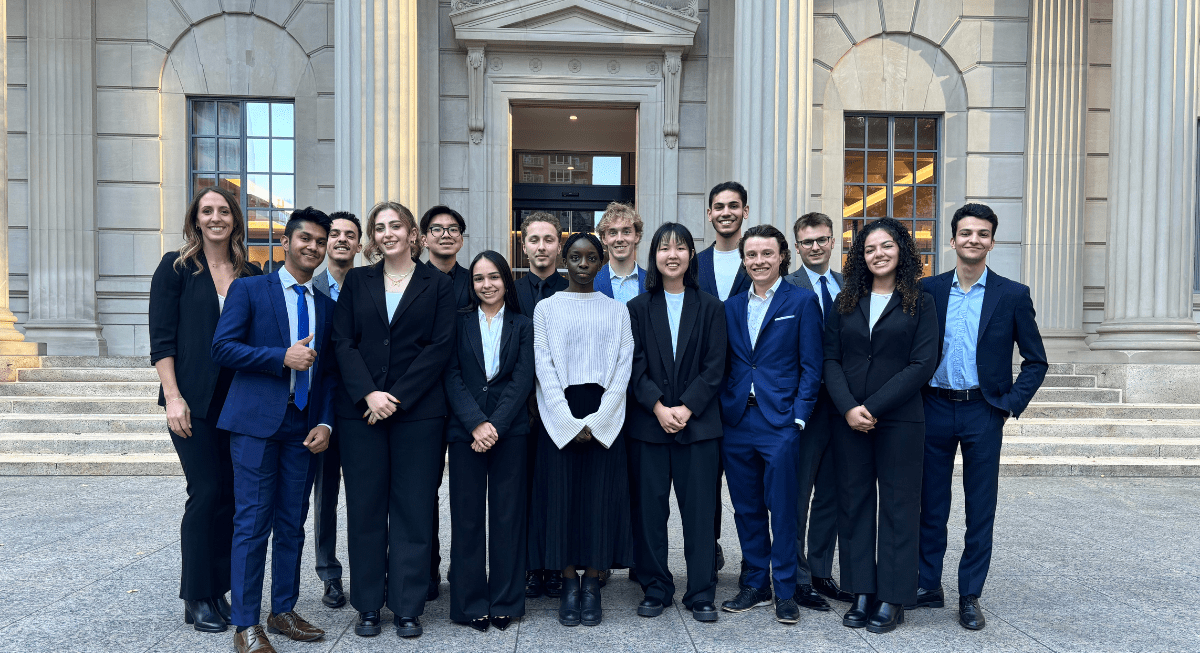

Nothing will prepare you better than physically stepping into the world of finance. Every year, our microprogram participants immerse themselves in the day-to-day of Canada’s leading financial institutions, both in Ottawa and Toronto. Ottawa visits take place throughout the year, while Toronto visits are organized in a trip during the fall Reading Week. Here is what portfolio manager leader, Basil had to say about his trip to Toronto:

“The Toronto trip is a highlight of the microprogram. It provides students with a behind-the-scenes glimpse of Canada’s financial capital. During my time on the trip, we were given the opportunity to talk to, learn from, and meet professionals in the industry.

Portfolio managers at RBC GAM taught us about their portfolio management process (from asset allocation to stock selection), while Burgundy Asset Management shared their perspective and unique organizational structure. Meanwhile, equity researchers and corporate bankers at National Bank taught us how the bank positions itself among Canada’s largest banks and how different capital markets divisions are connected.

We were also given the opportunity to network through Microprogram Capital Markets and uOttawa alumni, where we were able to build relationships, learn about their career paths, and absorb any advice they had for us. Not only were the students able to network and build relationships with industry professionals, but also the cohort itself grew stronger, with bonds and friendships forming throughout the course of the trip, over karaoke nights and late-night dinners. Meanwhile, the microprogram’s Toronto trip ended with closing the Toronto Stock Exchange, a truly memorable experience.”

– Basil El Said, Portfolio Manager Leader, Microprogram Capital Markets 2023-2024.

Use Telfer’s Financial Research and Learning Lab

The Financial Research and Learning Lab has all the tools employers are looking for when hiring students to work in capital markets. By spending time in the lab and absorbing all the experience it has to offer, you will build confidence and develop your skills. Students who participate in Microprogram Capital Markets meet every Wednesday evening in the lab to conduct their discussions, weekly meetings, and stock pitches. Since the lab is open to all students, you are welcome to step into the lab and take advantage of all its resources, even outside of the meetings. Not only is the lab available, but also the staff can assist you in building your confidence with tools, such as Bloomberg terminals, to prepare you for career success and differentiate you from your peers in the field. Here’s what Lab Supervisor Danielle Michaud and Lab Assistant Calvin Diallo had to say about the Telfer Financial Research and Learning Lab:

Lab Supervisor Danielle Michaud:

“The Finance Lab at the University of Ottawa is a cornerstone of experiential learning and an invaluable resource for students managing the Telfer Capital Fund. Here, students gain hands-on experience that is highly relevant to their future careers, learning to analyze financial data, identify market trends, and make informed investment decisions. In a world where employers increasingly require students to be proficient at manipulating data, the Finance Lab equips them with these essential skills. It’s not just about theory: it’s about practical, real-world applications that give students a competitive edge and prepare them to excel in finance and other data-intensive industries.”

– Danielle Michaud, Supervisor, Laboratory Support.

Lab Assistant Calvin Diallo:

“As a lab assistant and member of Microprogram Capital Markets, I would like to emphasize the crucial role played by the Financial Research and Learning Lab. This dynamic environment provides a unique opportunity to interact with students who share similar aspirations. Within this learning context, students develop essential skills, such as financial data analysis, financial modeling, and market research, which are vital skills in the financial markets.

The Lab offers training workshops as part of the HeadStart program. These programs include sessions on databases (Bloomberg and Capital IQ), valuation methods, as well as market, sector, and industry analysis. These workshops provide students with practical experience and information directly relevant to the financial industry.”

– Calvin Diallo, Assistant, Laboratory Support and Portfolio Manager, Microprogram Capital Markets 2023-2024.

Network with industry professionals

Networking is a great way to discover new perspectives and build relationships that can lead to future mentorship or job opportunities. The microprogram offers diverse opportunities to network with industry professionals in many different contexts. Participants can meet alumni and industry professionals through office visits, workshops, and guest speaker presentations, among other activities. Here’s what alumnus Aarun Senathirajah had to say about his networking experience in Microprogram Capital Markets:

“Microprogram Capital Markets, through its invited guests, alumni, and fellow students, helped introduce me to individuals and companies in the finance industry. These introductions and connections helped me understand what a career in the industry would be like and how I can best prepare myself for an opportunity. Equally as important, the bonds and connections formed with fellow cohort members are lifelong and have helped me fortify my professional and personal skills. These connections have opened the door for countless further opportunities.”

– Aarun Senathirajah, Honours Bachelor of Commerce, Specialization in Accounting.

Take advantage of internship opportunities

Microprogram Capital Markets offers you two separate internship opportunities. These internships are the ideal time to apply what you learn during the school year by doing practical work and setting yourself apart in the eyes of future employers.

Exploratory internship

The exploratory internship is optional and takes place before enrolling in Microprogram Capital Markets. Jump the learning curve by joining meetings, assisting analysts, and getting a taste of the action with the students in the microprogram.

Summer internship

A paid summer internship between your first and second year of the microprogram is compulsory to complete the microprogram. As a student, you need to find this internship outside of the university, directly in a financial institution. You will thus have an opportunity to work directly in the field and apply what you learned during the microprogram. This internship elevates your student experience not only by building your resumé and job search skills, but also by allowing you to step outside the classroom and build real-world knowledge.

Apply now

Any interested student, even those participating in the CO-OP program, can apply to be part of the next Microprogram Capital Markets cohort! Whether you are a first- or second-year finance student who wants to learn more through an internship, or you are a second-year student ready to apply, view the application process on the Microprogram Capital Markets admissions page.

Conclusion

Through Microprogram Capital Markets, Telfer can provide you with the tools and skills you need to reach your career goals in high finance. For more information about this microprogram, visit the Microprogram Capital Markets website or find the microprogram’s contact information through our contact page.