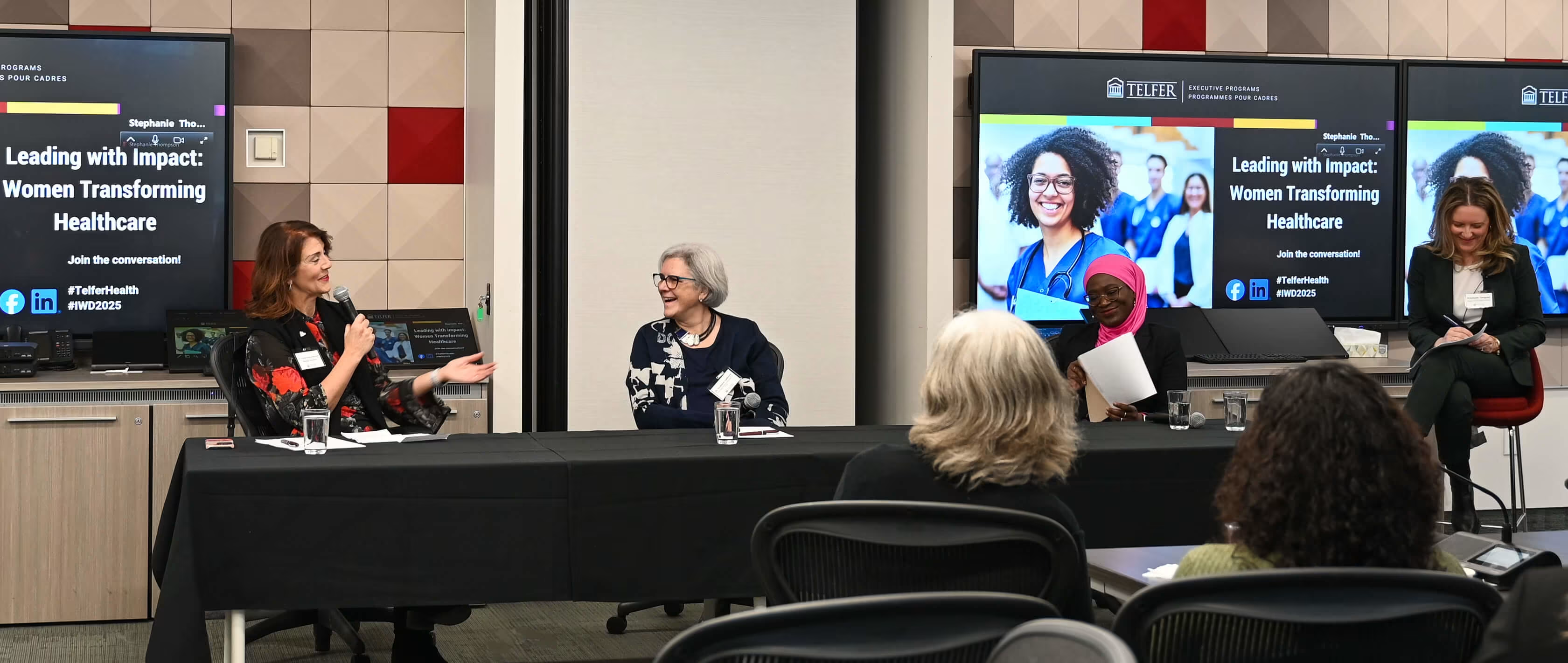

Throughout 2022 and 2023, the Family Enterprise Legacy Institute (FELI) at the Telfer School of Management and the Family Business Network (FBN) are partnering to deliver the NxG Legacy Forums — a series of eight panel discussions addressing the key questions for next generation members of business families. Topic questions for the forums have been selected from a new book, Enabling Next Generation Legacies: 35 Questions that Next Generation Members in Enterprising Families Ask, by Telfer professors Peter Jaskiewicz and Sabine Rau.

It may be the most repeated phrase in the family office space – once you’ve seen one family office you’ve seen one family office. Every situation is unique, and solutions needs to be tailored to the specific needs of the family. However, as seen during a discussion with representatives from two different family offices, there are also many commonalities from one family office to the next, even when the families come from different industries and countries.

During a recent FBN NxG Legacy Forum – with Jaskiewicz and Rau moderating and family office members Nathalie Marcoux and Abdullah Alsayer as panellists – the topic “We have wealth, when should we set up the family office to organize it?” led to a discussion of key family office themes such as the importance of a long-term view, the need for education, and taking the time to do things right.

Family Office Stewardship & Governance

Marcoux is VP Finance of her family office, Capinabel Inc, based out of Montreal, Quebec. The creation of a family office started organically after the business her father started – TC Transcontinental – went public, resulting in the business acquiring more wealth. Years later, after a liquidity event, it was decided there should be something more structured. “That’s when we started to have a more formal family office,” she explains.

Marcoux’s family office has several aims and goals, with the biggest being preservation of capital to benefit future generations. “I’m just a steward to grow that capital for the next generation,” Marcoux explained. “So they can have the same advantage that I got from that situation.”

Jaskiewicz echoed the idea of longevity, saying it is something he sees frequently as an aim. “The financial wealth of the family office should be seen as an endowment,” he said. “Part of what is created by past generations and should be passed on to future generations.”

Similarly, for Alsayer – Strategic Planning & Business Development Manager for Al Dhow Holding – his family office came about very naturally. “It started out with an accountant,” he said. “The wealth was there. We basically said we should try to do something about it.”

A long-term view is also important to Alsayer, citing sustainability and longevity as the main goals in his family office. To achieve this goal, Alsayer says the first priority is governance, and then investment second. “Those were the building blocks I wanted to focus on in the family office,” he added.

In terms of building the governance structure, Alsayer believes it should be created based on each individual family’s situation. “You have to build it on your family dynamic…and you have to align interests,” he said. “You bring the family together and you have to agree on the vision and the structure that best suits the family.”

Education – and the Value of Lunch!

When it comes to top recommendations for starting a family office, Alsayer says education, as well as having outside support – such as with a community like FBN – are the most important aspects. “The most important thing I found was education – really learning a lot before you implement,” he said. “FBN helped a lot – you get to meet really amazing people like Nathalie,” he added smiling, referring to his fellow panelist.

Education – and specifically financial literacy – is also top of the list for Marcoux in developing a family office, and she recommends basic training in finance and investments. “You don’t need to know everything in the details but know enough so you can ask questions.” Marcoux sees these questions as integral in finding new and better ways to run the family office. “By asking questions you’ll find the right people to work with you,” she said.

Marcoux also has a great idea for anyone wanting to learn more from other families – every time she meets someone she doesn’t know from a family office, she invites them to lunch! During these meetings Marcoux asks many questions such as “how does your family office work?”, “what are you working on now?”, as well as “how do you train your next gen?”. These discussions not only lead to greater insight and knowledge about family offices but also help build important connections in the family business community.

A Process…Not an Event

Both Marcoux and Alsayer agree that setting up a family office takes time and should not be rushed. Bringing the family together and crafting the vision – and building the structure of the family office – was the most difficult and took several years. “It started with a fishing conversation with my dad five, six years ago. We finished the skeleton pre-covid – two years ago.” Alsayer also sees it as an ongoing process. “We’re still going to work on it…we’re still going to enhance it going forward.”

Time is also an issue for Marcoux’s family office, and patience is necessary. After her family business’ liquidity event, she advised her father that it would likely take a full year until they could start investing the first dollar. “It takes time to select the right people. You need to meet, decide what you want, and time also to deploy the capital,” she said.

Adding to Marcoux’s point about taking time to find the right people, Rau had a cautionary tale from her PhD student’s research study. As Rau explained, “those who did not set up in a professional way, did not look out for people who were experienced in managing money instead of managing companies lost around about half of the wealth within the first year.”

Alsayer echoed Rau’s statement when answering a question about whether his family office is more about family or business. “Absolutely business,” he said. The eventual plan will be to not have any family members involved in the family office. “I’m building it because you need some of that passion in the very beginning and that drive to get it off to ground,” he explained. “But to be honest, I don’t want the family involved in the family office, only on a director/strategy level. Very, very business oriented. I want it to be a professional institutionalized organization, and that’s the goal we have as a family.”

More Insights to Come

Find out what happened at the first NxG Legacy Forum when Next Gen members shared their views on how to work constructively with family members in a business.

The third NxG Legacy Forum was all about how Next Gens can set themselves up for success and prepare in the long-run before joining the family business.

If you’re enjoying reading insights and advice from members of family enterprises, watch out for more from FELI on the Telfer Knowledge Hub.

To find out other ways Telfer is helping empower the next generation of business leaders, discover the Family Enterprise Legacy Institute and sign up for the Institute's newsletter.

-zhang.png)