Clearwater Seafood Inc. Receives Valuation at the Winter 2021 Finance Capstone

Telfer’s fourth-year Finance students complete their capstone course, Equity Valuation (ADM 4350), at the culmination of their studies. It is an opportunity for students to take all that they have learned throughout their years of study and apply it to a real-life situation. The students perform a case analysis of a chosen company to estimate the value of the organization and create an action plan to enhance its economic performance.

This semester, another great capstone competition commenced on April 9th, when the Equity Valuation class worked on their live case study to value Clearwater Seafoods Inc., the largest shellfish producer in North America. Based in Bedford, Nova Scotia, the company was recently acquired by Premium Brands Holdings and a coalition of Mi’kmaq First Nations on January 25, 2021.

After an exciting competition, the finalist groups went on to present their work online to a panel of judges to compete for the first-place position of strongest strategy.

After an exciting competition, the finalist groups went on to present their work online to a panel of judges to compete for the first-place position of strongest strategy.

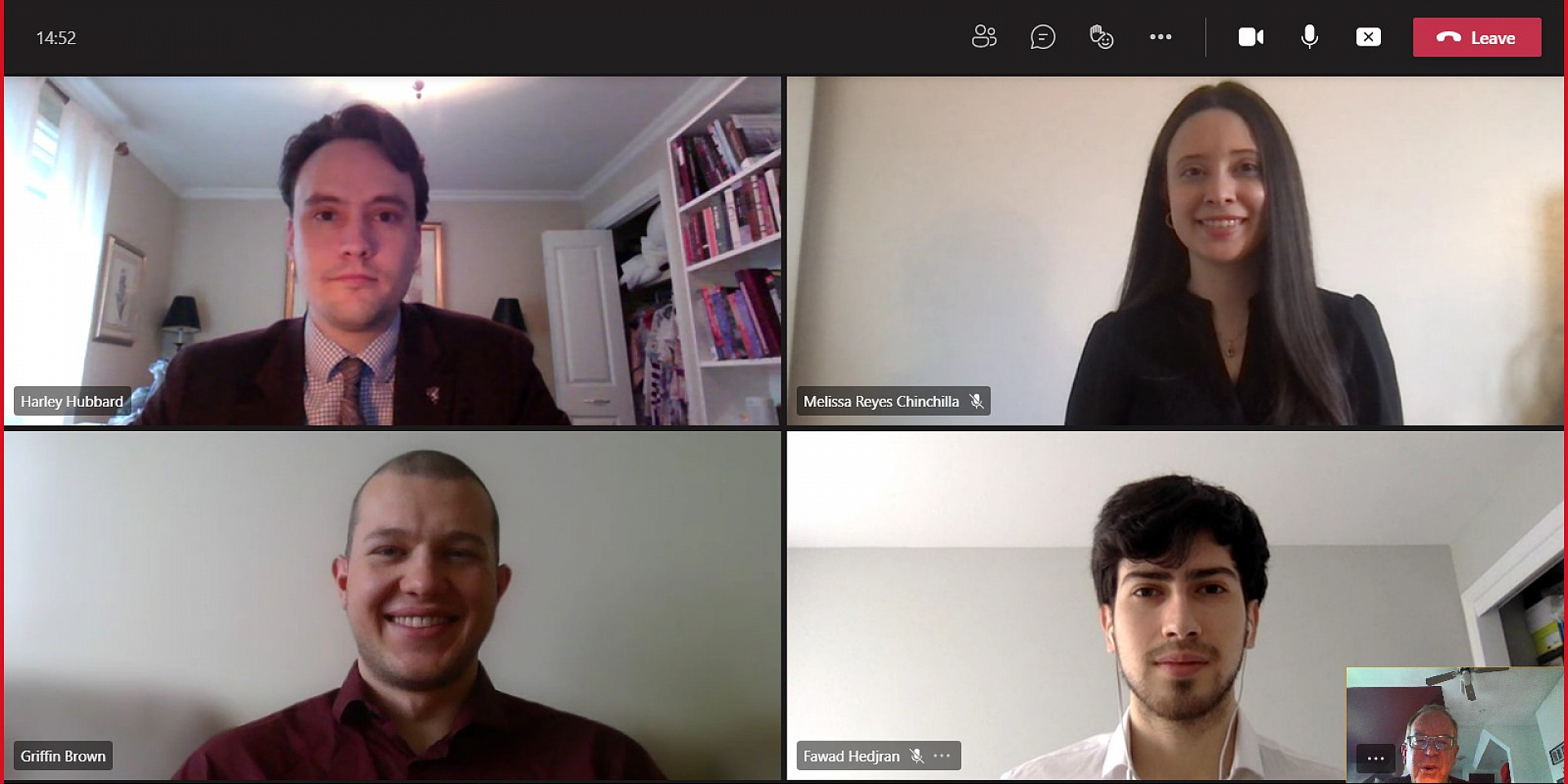

Congratulations to the first-place winners:

- Griffin Brown

- Fawad Hedjran

- Harley K. Hubbard

- Melissa Reyes Chinchilla

The winning team’s experience

We spoke to the first-place team and judges panel to learn more about this semester’s competition. Hubbard shared his highlights from the experience: "Our favourite part was hearing from the panel of nine distinguished judges. Ken Paul, the Director of Fisheries with the Assembly of First Nations, was very enlightening, and Alexander Comeau, of Fiera Capital, was also very knowledgeable. Overall, it was a great experience made possible by the tutelage of Professor Michael Reynolds."

When asked about their team’s greatest challenges, workload is the first thing that came to Hubbard’s mind: "Our greatest challenge was the time commitment and workload required; each of us balanced the competition with a full course load, extracurriculars, and internships. By leveraging each other’s strengths and working as a team, we succeeded,” he concluded.

Furthermore, Ken Paul provided enlightening comments from the indigenous perspective. He indicated that the Clearwater valuation, mergers and acquisition (M&A) provided students the opportunity to reflect on important indigenous ethical considerations: "One of the biggest differences between Indigenous fishers and non-Indigenous fishers, is that in our Canadian society, we always think about maximizing economic gain," Paul shared. "In the indigenous world, a critical consideration is the need to leave some of the resource for future generations. Concepts such as corporate social responsibility and environmental sustainability really mean something and are embedded in the value system of First Nations peoples."

Paul emphasized: “we had had to ensure the First Nations communities approached this M&A on a commercial base, which will benefit the communities economically.” He stressed that the Clearwater acquisition was commercial and did not involve treaty issues, such as the Indigenous maritime lobster fisheries issue that was in national news during the fall of 2020.

Congratulations again to the winning team for their work and excellent presentation!